International Trade Research

As the international trade environment becomes increasingly complex to navigate, businesses with a dynamic trade strategy have a competitive advantage.

In the export business, it doesn’t matter if you are a newcomer for the first time or an established exporter looking to grow your business abroad.

From assessing trade barriers to prioritizing access to new markets and stakeholder engagement, we can help you meet the challenge. Our comprehensive market research services deliver bespoke and tailored insights into which countries may provide the best opportunities for your business.

We will be able to connect buyers and suppliers and access the exclusive market research database provided by us. We also have a network of industry experts all around the world organisations. This enables us to access their expertise and industry network through internal communication.

Trade facilitation

Our primary goal of trade is to connect you between buyer ; supplier and help make trade across borders (imports and exports) faster, and cheaper and more predictable, whilst ensuring its safety and security. In terms of focus, it is about simplifying and harmonizing formalities, procedures, and the related exchange of information and documents between the various partners in the supply chain

Market research for buyers and sellers

Finding the right manufacturer for your new product is crucial to your success. Manufacturers control your product’s cost, quality, and packaging, and shipping. Here’s how you can find the perfect ones.

The Trusted Commercial connects buyers and Suppliers around the world. It’s a leading B2B and B2C marketplace that connects buyers and suppliers around the world in order to conduct buying and selling activities.

The B2B Marketplace ( business-to-business) connects companies and manufacturers. Businesses sell products and services to other businesses and The B2C Marketplace (business-to-consumer) provides businesses with opportunities to sell products and services directly to consumers.

The Trusted Commercial is a common marketplace to find existing products, but you can also use it to connect with manufacturers to create custom products. Simply search for the products you’re looking for and browse through the various suppliers and manufacturers. The marketplace lets you vet manufacturers upfront to get the best products at a fair price.

The Global Market is recognized as a powerful instrument to stimulate economic progress, reduce poverty, and contributes to eradicating extreme hunger and poverty, by halving the proportion of people suffering from hunger and living

Global Food Crisis – What Causes Food Insecurity?

The reasons for hunger and food insecurity are many and vary from country to country, but generally, it is a result of conflict, poverty, economic shocks such as hyperinflation and rising commodity prices, and environmental shocks such as flooding or drought.

The conflict in Ukraine has sent global food prices skyrocketing. A third of the world’s wheat supplies come from Ukraine or Russia. Ukraine also supplies the world with sunflower oil, barley, maize, and fertilizers. But ongoing conflict means that fields won’t be prepared, crops won’t be planted and fertilizers won’t be available.

COVID-19 also caused a sharp rise in poverty and inequality globally, as lockdowns devastated family livelihoods. In many countries, pandemic restrictions also meant disruption to food supplies, slowing remittances from family overseas, and the halting of school meal programs. Steep rises in food prices are also creating immense strain on household budgets, with the poorest families hardest hit.

Climate change has contributed to food insecurity by changing weather patterns such as rainfall, and increased climatic shocks such as hurricanes, cyclones, floods, and droughts which all have an impact on harvests. Climate change has also increased the prevalence of crop pests such as locusts, which damage and destroy harvests.

Inflation and economic shocks have impacted the access to food for many people. Even if food is available, for many people it is too expensive to buy reducing people’s access to food. Linked to the Pandemic, many people have lost their livelihoods and income, again reducing families’ ability to purchase food.

Solving the food crisis

Open markets have a crucial role to play in raising production and incomes. Trade enables production to be located in areas where resources are used most efficiently and has an essential role in getting products from surplus to deficit areas. Trade also raises overall incomes through the benefits to exporters (in the form of higher prices than would be received in the absence of trade) and importers (through lower prices than would otherwise be paid), while contributing to faster economic growth and rising per capita incomes.

Getting world food markets to function more smoothly will also require wider efforts at the multilateral level

B2B Marketplaces are shaping the Future of B2B E-commerce

The B2B e-commerce industry has had a love/hate relationship with marketplaces over the last 20 years. Around the turn of the millennium, B2B marketplaces went looking for love from B2B buyers and sellers, but the resulting affair was short. The technology was inadequate to nonexistent, buyers and sellers on a wide scale were not interested, and competitive differences kept industry marketplace coalitions from working successfully

together.

Fast forward to 2022, and B2B buyers and sellers are in love once more with marketplaces. And the feeling from marketplace operators is mutual. B2B marketplaces are now the fastest-growing channel in B2B e-commerce, based on a market projection from Digital Commerce 360.

How big are B2B marketplaces getting?

Sales on B2B marketplaces shot up 131% to $56.5 billion in 2021. And they are projected to increase at a similar pace to $130 billion in 2022.

Since the pandemic struck more than two years ago, the B2B e-commerce landscape has changed dramatically. B2B E-commerce and B2B marketplaces are now mainstream. Sales on B2B marketplaces have increased 5.3 times in just two years, from 2020 to 2022 (projection). And B2B marketplaces in 2023 and beyond will become even more mainstream. In 2022, B2B marketplaces grew 7.2 times faster than all B2B e-commerce, based on a projection from Digital Commerce 360.

B2B buyers find marketplace shopping useful

B2B buyers, like consumers, turned to websites to make purchases when the COVID-19 pandemic struck in early 2020, making face-to-face transactions impossible in many cases. When Digital Commerce 360 asked business buyers in March 2022 how the pandemic changed their buying behavior, the top response, selected by 52%, was that they went to “e-commerce sites as they have more selection.” In the same survey, 57% of buyers said they were purchasing more from B2B online marketplaces during the pandemic, and 17% said they were buying “significantly more” than before. And 35% of B2B buyers report getting at least half of their shopping done on marketplaces. Amazon Business remains the single most dominant B2B marketplace. 43% of B2B buyers expect their total spending on Amazon Business to increase over the

course of 2022.

Are investors interested in B2B marketplaces too?

Despite challenging economic conditions, investors continue to pump funding into B2B marketplace companies, says Bowery Capital. In 2021, there were 111 deals completed, and the pace did not fall off so far in 2022. Through May, there have been a total of 63 deals.

The biggest marketplace deal tracked by Bowery Capital so far was $2.2 billion for Flexport, a Transportation & Logistics marketplace. That service sector has seen $7.05 billion in marketplace funding in the past 12 months, the highest of any category. The Labor sector has seen 21 deals worth $2.31 billion in the past 12 months. Additionally, Manufacturing & Industrial has seen $2.35 billion in funding in the past 12 months, Retailing has enjoyed $1.40 billion in funding, and Agriculture has received $1.24 billion.

B2B marketplaces offer various benefits, such as digital capabilities, scalability, accuracy in analytics, and a customer-centric approach. Moreover, technological proliferation, such as the application of artificial intelligence and cloud technology, has enabled the B2B e-commerce market to offer an improved customer experience. The internet has emerged as a powerful tool for connecting sellers and buyers more efficiently. Internet capabilities have a profound impact on an organization’s value chain.

The COVID-19 pandemic has accelerated the demand for e-commerce during a period of slow economic activity. In the first half of 2020, the pandemic impacted several businesses across the globe. With stay-at-home restrictions, numerous consumers and businesses went digital to buy and sell goods and services online. Moreover, the proliferation of cloud services and web applications has boosted the demand for B2B e-commerce businesses. Manufacturers, wholesalers, and distributors have been undergoing digital transformation gradually over the years to create a sustainable future for their respective businesses. In December 2020, Amazon.com, Inc. announced that Nationwide Mutual Insurance Company, a British mutual financial institution, has expanded its partnership with AWS by selecting it as its cloud provider for the company-wide digital transformation.

Flexible payment options favor business owners. The changing B2B buyer behavior and a strong emphasis on streamlining purchasing processes are prompting B2B e-commerce companies. This, in turn, offers payment methods, such as third-party payments and mobile wallets, as part of their efforts to make B2B transactions more convenient. For instance, in December 2021, Newegg Commerce, Inc. partnered with Affirm, Inc., a payment network, to provide flexible payment options such as pay-over-time to customers shopping from Newegg.com. Paying with Affirm incurs no hidden costs or late fees and allows customers to split the purchase into simple payments over time. Affirm, Inc. provides its customers with transparency, flexibility, and control at checkout. Businesses are expected to find account-based transfers more appealing during the forecast period, owing to their improved speed and security. Further, improvements in real-time payment technologies are likely to foster their adoption, creating a favorable environment for online business transactions.

Several companies are making significant investments in automated payables and real-time payment technologies, which is expected to contribute to the segment growth during the forecast period. Factors such as favorable regulations supporting consumer protection and cross-border trade regulations are expected to boost e-commerce sales. Various government bodies worldwide are also amending and strengthening data security and privacy protection laws as part of their efforts to build consumers’ trust in B2B e-commerce platforms.

However, concerns around payment security and data privacy, coupled with the need for ongoing investments, such as technological upgrades, cap-ex investments, software licenses, implementation costs, infrastructure costs, and server provisioning costs, are expected to pose a challenge for the market growth. B2B e-commerce enhances supply chain efficiency by providing real-time data for components, such as product availability, inventory, shipment status, and production requirements. Moreover, it helps to improve communication within the supply chain, allowing OEMs to organize inventory deliveries, logistics, and other activities to ensure improved efficiency and reliability.

Deployment Type Insights

Based on deployment type, the market can be segmented into supplier-oriented, buyer-oriented, and intermediary-oriented models. The intermediary-oriented segment dominated the market in 2021, recording a revenue share of over 50.0%. This model regulates trade among manufacturers and consumers. Moreover, it frees up businesses, particularly MSMEs, from the high cost of website development, logistics, and customer support, making it a popular choice.

The supplier-oriented business-to-business e-commerce model is also expected to witness an uptake, registering a CAGR of over 15.0% from 2021 to 2030. This model is a preferred choice among local businesses seeking to venture into unfamiliar regions or countries.

Dell Inc. is a classic example of a company that implements the supplier oriented deployment model.

Global Trade Outlook 2022

Our forecasting model predicts the real value of global trade to go up to USD 20,175 billion in 2021 and USD 21,038 billion in 2022.

Therefore, IHS Markit anticipates a year-on-year increase in the real value of global trade by 12.6% in 2021 (prior, it was +8.5%) and by 4.3% in 2022.

The global merchandise trade volume forecast will grow to 15.2 billion metric tons in 2021 and 15.8 billion metric tons in 2022 (significantly higher than our prior forecasts for

2022). It points to a recovery in the forthcoming years with year-on-year growth rates of 8.7% in 2021 and 4.4% in 2022 (an adjustment by + 2.1% and 2.0%, respectively).

The Omicron variant can adversely affect economic activity in Q1 2022. Supply chain disruptions are unlikely to subside in H1 2022.

Introduction

2021 was the second year of the ongoing COVID-19 pandemic, marked by rapid recovery from the dramatic 2020 resulting from the initial outbreak in Q1 2020. Q2 of 2020 proved to be the worst quarter for global trade on record, but the situation started to improve relatively fast. Global trade is already at levels seen before the pandemic, but the growth rates peaked in Q2 2021 and then moderated. The recovery brought nonetheless several problems which proved to be persistent and will still affect global economic activity, at least in H1 2022. The present article will investigate these in detail.

Global trade in 2020

IHS Markit Global Trade Analytics Suites (GTAS) Forecasting team now estimates the

contraction of global merchandise trade in 2020 to USD 17,921 billion or -5.5% year-onyear. In terms of volumes,

GTAS Forecasting estimates a contraction of global trade in

2020 to 13.94 billion metric tons or by -4.2% year-on-year.

In comparison, the WTO estimated the fall in volume to be -5.3%, IMF estimated it to be

-8.3% (for the volume of trade in goods and services), and WTO (June 2021 Outlook) at –

8.3% for the volume of trade in goods and nonfactor services.

The ongoing COVID-19 pandemics

The COVID-19 pandemic is the most prominent driver of the current global economic situation. As a pandemic cannot be fully predicted, it leads to significant uncertainty. The reaction in trade in 2020 was to a large extent consistent with the escalating global COVID-19 pandemic and steps taken by individual countries/territories in controlling or mitigating it.

The overall impact of COVID-19 on worldwide trade and the global economy will depend on the duration, severity, and spatial distribution of the pandemic and directly linked to the severity of containment efforts taken by individual states. The reaction of states is mainly related to the capacity of their health systems to cope with the number of incoming patients (hospitalizations) and the corresponding number of reported deaths showing to some extent the incapacity of health systems to manage. It seems that with the duration of the pandemic, governments and international

organizations learned to react to it and mitigate it in a more balanced and less harmful

way.

The health crises, such as COVID-19, create problems both on the supply side (e.g., due to lockdowns, forced production stoppages, disrupted global value chains) and demand side (e.g., lower consumer confidence, delayed consumption, lower incomes). The impact of COVID-19 on the worldwide economy outweighed the prior outbreaks of SARS or MERS. It resembled more the effect of the infamous Spanish Flu of 1918-20. In terms of the duration of the pandemic, we can expect it to endure up to 3 years. It could transform in 2022 from pandemic to endemic.

Recent econometric analysis on monthly processed bilateral trade flows by the GTAS

Forecasting team has shown that COVID-19 still exerts an adverse impact on international trade flows; however, the effect is slowly diminishing in magnitude (it is observed both for new cases, new deaths, as well as COVID-19 monthly average of daily Oxford’s Government Response Tracker on the stringency of response to the pandemic by individual states).

The global economy is not reacting as such to the pandemic itself but mainly due to the severity of reaction by individual states and changes in it and due to the shifts in behavior of economic agents.

The overall impact of COVID-19 on global trade and the global economy depends on the duration, severity, and uneven spatial and temporal distribution of the pandemic (changing with the subsequent waves of the pandemic) and the associated severity containment efforts taken by individual states.

The health crises create problems both on the supply side (e.g., due to lockdowns, forced production stoppages, disrupted global value chains) and demand side (e.g., lower consumer confidence, delayed consumption, lower incomes) On 26 November 2021, WHO designated a new SARS-Cov-2 variant B.1.1.529 as a variant of concern, named Omicron, on the advice of WHO’s Technical Advisory Group on Virus Evolution. This decision was based on the evidence that Omicron has several

mutations that may impact the speed of spread, higher transmutability, or the severity of illness it causes; the markets reacted strongly to the new adverse information with an increasing number of states reintroducing stricter contingency measures.

The full impact of Omicron will be known only within several weeks when we will understand the severity of the mutation. Nonetheless, it is likely to impact global economic activity in Q1 2022; the variant potentially could become an adverse game changer.

The cumulative number of confirmed cases of COVID-19 globally by 1 January 2022 reached 289.3 million and 5.45 million deaths.

The 2-week moving averages of new cases globally started to rise again by the end of October 2021, with global average death rates following with no apparent delay. Omicron led to the highest number of new cases reported since the pandemic outbreak in the last week of 2021, with no immediate impact, yet, on the number of COVID-19 related deaths.

To illustrate the problem, in the U.S. the number of cases jumped to 500k daily in the last week of 2021 and then to 1 million confirmed cases daily in the first days of 2022. Thus, the shift from pandemic to endemic is becoming an actual reality.

There are two areas of concern now: the change in the number of hospitalizations (capacity of the health system to cope with the Omicron wave) and the level of vaccinations in the population.

According to some researchers, vector vaccines such as the Russian Sputnik or the Chinese Sinopharm and Sinovac’s CoronaVac provide limited protection against Omicron, even with a booster dose, compared to mRNA vaccines such as Pfizer (PFE) or Moderna (MRNA).

Thus, it could bring the countries that based their reaction to COVID-19 on vector vaccines under more significant pressures (particularly China (mainland) and Russia) in particular in Q1 2022.

Youth unemployment statistics

372,000 young people aged 16-24 were unemployed in June-August 2022, down 62,000 from the previous quarter and down 122,000 from the year before. This was the lowest level of youth unemployment since records began in 1992. The unemployment rate (the proportion of the economically active population who are unemployed) for 16–24-year-olds was 9.0%. This is down from 10.4% in the previous quarter and down from 12.1% from the year before. The number of young people in employment was around the same in June as the previous quarter but increased by 137,000 from the previous year to 3.74 million. The number who are economically inactive (not in or looking for work) increased by 79,000 from the previous quarter and remained at a similar level to the year before at 2.72 million. 78% of the young people who are economically inactive are in full education. The inactivity rate for young people is 39.8%, up from 38.8% in the previous quarter.

Trends in youth unemployment

After reaching a peak of 22.5% in 2011 following the 2008 financial crisis, youth unemployment rates fell until the start of the pandemic to 12.3% in January, Youth unemployment did initially rise after the outbreak of t unemployment rate reaching a high of 14.9% in July unemployment were 15% higher in this quarter than they were previous. Since then, youth unemployment has been steadily falling. There were 16% unemployed young people in June fall. The youth unemployment rate has fallen from 12.3% to 9.0% during this period.

young people in employment was around the same in June as the previous quarter but increased by 137,000 from the previous year to 3.74 million.

The number who are economically inactive (not in or looking for work) increased by previous quarter and remained at a similar level to the year before at 2.72 million. 78% of the young people who are economically inactive are in full The inactivity rate for young people is 39.8%, up from 38.8% in the previous quarter.

ds in youth unemployment

After reaching a peak of 22.5% in 2011 following the 2008 financial crisis, youth

unemployment rates fell until the start of the pandemic to 12.3% in January Youth unemployment did initially rise after the outbreak of the pandemic, with the youth unemployment rate reaching a high of 14.9% in July-September 2020. Levels of youth unemployment were 15% higher in this quarter than they were pre-pandemic.

Since then, youth unemployment has been steadily falling. There were 16% unemployed young people in June-August 2022 compared to January fall. The youth unemployment rate has fallen from 12.3% to 9.0% during this period.

Young people in employment was around the same in June-August 2022 as the previous quarter but increased by 137,000 from the previous year to 3.74 million.

The number who are economically inactive (not in or looking for work) increased by evious quarter and remained at a similar level to the year before at 2.72 million. 78% of the young people who are economically inactive are in full-time The inactivity rate for young people is 39.8%, up from 38.8% in the previous quarter.

After reaching a peak of 22.5% in 2011 following the 2008 financial crisis, youth unemployment rates fell until the start of the pandemic to 12.3% in January-March 2020. he pandemic, with the youth September 2020. Levels of youth pandemic.

Since then, youth unemployment has been steadily falling. There were 160,000 fewer August 2022 compared to January-March 2020, a 30% fall. The youth unemployment rate has fallen from 12.3% to 9.0% during this period.

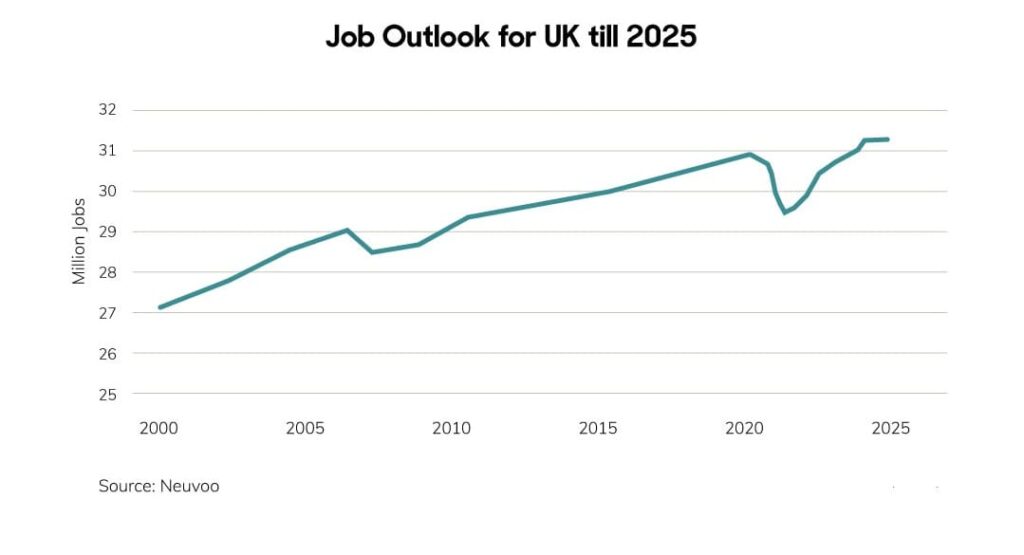

What lies ahead for the UK job market in 2022

Many people are moving jobs, with job seekers shopping around for what matters to them, says Jack Kennedy, UK and Ireland economist at Indeed. Jack Kennedy works for the Indeed Hiring Lab, an international team of economists who deliver insights on the global labour market.

“We are seeing a record number of job switches in data from the Office for National Statistics (ONS): a million people made job-to-job moves in the third quarter. But here at Indeed, we are not seeing too much evidence that there’s been a mass reassessment of people’s work priorities. If you look at the recent job-to-job moves, more of them have been within the same industry than pre-pandemic. So, it’s not like we’re seeing a mass switch into different fields. We see it as job seekers taking advantage of plentiful opportunities, in some cases moving to take advantage of higher wages on offer,” says

Kennedy.

Active UK labour market

The UK labour market is extremely active, Indeed’s research shows, with job postings on Indeed up 39 percent from February 2021, seasonally adjusted.

Kennedy says one trend that is very real is workers looking for remote roles, which have increased by more than 500pc2: “We saw spikes in remote work interest, particularly during periods of lockdown, but in the last few months, really since the start of this summer we’ve seen that trend increasing again.

“Job-seekers remain interested in remote work. It may be that there are some people that are being asked to come back into offices and aren’t particularly keen to do so. They are increasingly looking for alternative roles where they can continue to work remotely.”

Kennedy says that the ups and downs of the pandemic and post-pandemic job market have seen job seekers become more entrepreneurial.

“We saw huge increases in searches for jobs in reopening sectors earlier in the year in places like garden centres – when it was announced they’d be among first businesses to reopen – and places like Covid-19 testing centres. We’ve also seen more recently that media reports of rising pay for HGV drivers boosted job seekers looking for those very highly in-demand roles.”

A tumultuous year for the job market

The trends come out of a tumultuous year for the job market, Kennedy says.

At the start of the pandemic, job postings bottomed out at 60pc of pre-pandemic levels, and UK recovery was slow.

“We had the slowest recovery of the G7 countries in terms of job postings across the countries that we operate in. We didn’t see that pace of recovery really kicking up a gear from around the spring of 2021 after the Government announced its roadmap out of Covid restrictions, effectively switching the economy back on. So we passed the pre-pandemic

baseline job postings last May and, since then, we’ve just seen continued very strong growth in job postings.”

Kennedy says that Indeed Hiring Lab has created “deep dive” reports on the changes in the labour market – including the impact of Brexit.

“We have a number of clients who have been very mindful of the impact of Brexit. We found that as well as diminishing EU job-seeker interest, we’re seeing rising interest from outside the EU, particularly in higher-paid jobs in sectors like tech, engineering, and healthcare. For instance, job-seekers from Pakistan are looking for software developer jobs in the UK.”

Employers have embraced tech innovations such as video interviews to attract talent,

Kennedy says. And in some sectors, employers have had to raise wages to try and attract

talent in the face of huge demand for workers.

“We’ve seen that many employers, particularly in these sectors that have had very strong

demand growth, have been reaching for the one lever they can control, namely pay. So we have seen that wages have risen very strongly, where there is high demand in particular sectors in a bid to attract new or returning workers.”

But Kennedy says that above-inflation wage rises are still limited to a few sectors. “We’re not really yet seeing that broaden out across the market as a whole. We saw a 4.1pc annual increase in December 2021 in median advertised wages in job postings, below the rate of consumer price inflation. But the most in-demand sectors like food service, construction, manufacturing, nursing, warehousing and driving saw wage increases around 7-8pc.”

Changing needs of workers

“Employers need to meet people in the middle to some extent. It’s about an overall holistic approach. So, particularly for employers that are finding hiring very challenging at the moment, we are seeing them looking at things like flexible working provisions, and parental leave policies to attract and retain parents. “We’re seeing that younger people, particularly, care about things like ESG

[environmental, social, and governance] issues and things like the gender pay gap. So employers need to think about a rounded view about what they can offer to people looking for work,” says Kennedy.

Kennedy believes that “employer branding” is going to be increasingly important in a job

market where employers are competing to hire. He says: “It’s going to be the ability to really sell what their organization can offer for the job-seeker. People do have a lot of opportunities in the current market. So, employers need to be very aware of things like employee reviews, making sure that they have a lot of information easily accessible to job-seekers about why people should go and work

for their company specifically. There’s a lot of competition. They need to think about

how they can really differentiate their offering, and sell that vision to the job-seeker.”

Reference

https://www.thetrustedcommercial.com

https://www.telegraph.co.uk/business/future-of-recruitment/uk-job-market/

https://commonslibrary.parliament.uk/research-briefings/sn05871/

https://www.digitalcommerce360.com/article/future-of-b2b-marketplaces/

https://seekingalpha.com/article/4479178-global-trade-outlook-2022-moderate-growth-supply-chain-disruption-likely-to-continue-in-h1